Life is short Take the risk forgive quickly , love truly laugh constantly And never stop smiling no matter how strange life is Life is not always the party we expected to be but as long as we are here, we should smile and be grateful.

Wednesday, April 22, 2009

Tuesday, April 21, 2009

Monday, April 20, 2009

Friday, April 17, 2009

Wednesday, April 15, 2009

Thursday, April 9, 2009

up trend regain support . @913

人啊!沒錢的時候,養豬;有錢的時候,養狗。沒錢的時候,在家裡吃野菜;有錢的時候,在酒店吃野菜。沒錢的時候,在馬路上騎自行車;有錢的時候,在客廳裡騎自行車。沒錢的時候想結婚;有錢的時候想離婚。沒錢的時候老婆兼秘書;有錢的時候秘書兼老婆。沒錢的時候假裝有錢;有錢的時候假裝沒錢。人啊,都不講實話:說股票是毒品,都在玩;說金錢是罪惡,都在撈;說美女是禍水,都想要;說高處不勝寒,都在爬;說煙酒傷身體,就不戒;說天堂最美好,都不去!!!當今社會,窮吃肉,富吃蝦,領導幹部吃王八;男想高,女想瘦,狗穿衣裳人露肉;過去把第一次留給丈夫;現在把第一胎留給丈夫。鄉下早晨雞叫人,城裡晚上人叫雞;舊社會戲子賣藝不賣身,新社會演員賣身不賣藝。人生是什麼?只 用 了 4 4 個 字 , 就 把 人 生 講 完 了 ....所 以 人 與 人 , 有 啥 好 計 較 的 咧 ? 快樂好相處比較重要啦!1 歲 時 出場亮相10 歲 時 功課至上20 歲 時 春心盪漾30 歲 時 職場對抗40 歲 時 身材發胖50 歲 時 打打麻將60 歲 時 老當益壯70 歲 時 常常健忘80 歲 時 搖搖晃晃90 歲 時 迷失方向100 歲 時 掛在牆上祝大家愉快,好好做人!

Wednesday, April 8, 2009

Tuesday, April 7, 2009

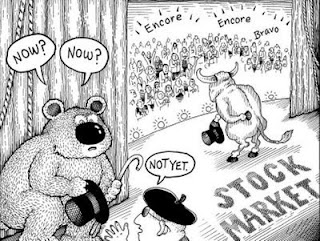

fake bull ? dun worry, the chart will tell when this is fake

April 7 (Bloomberg) -- George Soros, the billionaire hedge- fund manager who made money last year while most peers suffered losses, said the four-week rally by U.S. stocks isn’t the start of a bull market because the economy is still shrinking.

“It’s a bear-market rally because we have not yet turned the economy around,” Soros, 78, said in an interview yesterday with Bloomberg Television, referring to a temporary rebound in stock prices. “This is not a financial crisis like all the other financial crises that we have experienced in our lifetime.”

The Standard & Poor’s 500 Index of the largest U.S. companies has gained 24 percent since March 9 on optimism that the worst of the 16-month U.S. recession is over. The economy continues to contract, and there’s a risk the U.S. falls into a depression, Soros said.

“As long as we deal with this in a multilateral and more or less coordinated way, I think we’ll get through,” he said.

Soros gave a mostly positive review of the President Barack Obama’s administration.

“He’s done very well in every area, except in dealing with the recapitalization of the banks and the restructuring of the mortgage market,” said Soros, who has published an updated paperback version of his book “The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What It Means (Scribe Publications, 2009). “There, unfortunately, there’s just a little bit too much continuity with the previous administration.”

U.S. stocks fell for the first time in five days yesterday on concern that government measures to shore up banks may not help as much as expected and loan losses will exceed levels from the Great Depression. Soros said the banking system is “seriously under water” with banks on “life support.”

‘Zombie’ Banks

“They are weighed down by a lot of bad assets, which are still declining in value,” he said in the interview in his New York office. “The amount is difficult to estimate, but I think it’s in the region of maybe a trillion-and-a-half dollars.”

Soros said the change to fair-value accounting rules will keep troubled banks in business, stalling a U.S. recovery.

“This is part of the muddling-through scenario where we are going to keep zombie banks alive,” Soros said. “It’s going to sap the energies of the economy.”

The Financial Accounting Standards Board last week relaxed so-called mark-to-market rules, allowing banks to use “significant” judgment in gauging prices of some investments on their books. While analysts said the measure may reduce writedowns and boost net income, investor advocates and accounting-industry groups said it will help financial institutions hide their true health.

Nationalization Bugaboo

“This bugaboo of nationalizing the banks, which President Obama has determined not to do, the result is that we are nationalizing only one side of the balance sheet,” Soros said. “We gradually take over the deficits on the balance sheet. But we are not actually going to benefit from the banks recovering.”

Money being injected into banks under government rescue programs should be used to finance new leading, according to Soros. He said he participated in HSBC Holdings Plc’s rights offer, which raised about $17.7 billion last week.

Soros’s firm oversees $21 billion. Its Quantum Endowment Fund returned 8 percent in 2008. That compared with an average loss of 19 percent by hedge funds, according to data compiled by Hedge Fund Research Inc. of Chicago. The fund is up 5.2 percent this year through February, according to data compiled by Bloomberg.

Soros was ranked as last year’s fourth-highest paid hedge fund manager with about $1.1 billion, according to Institutional Investor’s Alpha magazine.

Hedge-Fund Regulation

Soros said hedge funds should be regulated like other financial firms and that it would be appropriate for authorities to monitor positions to see whether some managers have “excessive exposure.”

The Group of 20 leaders said last week that they would extend oversight to all financial institutions deemed vital to global financial stability, including for the first time “systemically important” hedge funds. U.S. Treasury Secretary Timothy Geithner said last month he wants to bring hedge funds, private-equity firms and derivatives markets under federal supervision for the first time.

“The hedge funds that have used excessive leverage have actually failed or are on the way out, so I don’t think this is going to do any damage or hurt the hedge funds except for the fact that they have to fill out more forms,” Soros said.

“Recognizing that markets are inherently unstable does require a different kind of regulation than we had in the past,” he said.

Hungarian Ruling

Soros’s Soros Fund Management LLC was last month fined 489 million forint ($2.2 million) for attempting to manipulate the share price of OTP Bank Nyrt., Hungary’s largest bank, the country’s financial regulator said.

The Soros fund attempted on Oct. 9 to “send out false or misleading signals about a security’s supply and demand or its share price” and short sold OTP shares, the regulator, known as PSZAF, said in a statement late yesterday. The short selling caused the shares to drop 14 percent in the final 30 minutes of trade, the regulator said. Soros apologized for the trade and said the fund had started an internal investigation.

Soros said that the U.S. housing market hasn’t reached a trough, even as transactions in some areas such as California have increased.

“There are some signs of hitting bottom, but we are not there yet,” he said. “A lot has been done to forestall foreclosures.”

China’s Stimulus

Hungarian-born Soros gained fame in the 1990s when he broke the Bank of England’s defense of the pound and drove the currency from Europe’s system of linked exchange rates. He also successfully bet that Germany’s mark would rise after the collapse of the Berlin Wall in 1989 and Japanese stocks would start to fall in the same year.

Soros said China’s economic growth will accelerate before the end of the year.

“They have a pretty big stimulus package,” he said. “They are going to use more, because not being a democracy, the leadership knows that their very survival, the avoidance of social unrest, requires them to generate growth.”

China’s economy in the fourth quarter grew 6.8 percent from the same period a year earlier, lagging the 9 percent expansion in all of 2008 and 13 percent in 2007. Industrial output growth slowed, forcing thousands of factories to close and leaving about 20 million migrant workers jobless.

Brazil’s economy will resume growth “relatively soon,” helped by Chinese demand for iron ore and soybeans, Soros said.

“I think Brazil actually, together with China, will be among the recovering countries. I think the outlook for Brazil is better than for most other countries.”

To contact the reporter on this story: Kathleen Hays in New York at khays4@bloomberg.net; Saijel Kishan in New York at skishan@bloomberg.net Last Updated: April 7, 2009 00:01 EDT

Monday, April 6, 2009

extend trend, ..in opening

Friday, April 3, 2009

Thursday, April 2, 2009

s1 885 s2 880 s3 878 r1 900

Wednesday, April 1, 2009

Tuesday, March 31, 2009

Subscribe to:

Posts (Atom)